IEP and IEV Mechanism

What do the terms Indicative Equilibrium Price (IEP) and Indicative Equilibrium Volume (IEV) mean?

- Indicative Equilibrium Price (IEP) is the information about potential transaction prices that will be formed during the pre-opening session, pre-closing session, and call auction session of the watchlist board

Indicative Equilibrium Volume (IEV) is information about the potential transaction volume that can be matched at the price that will be formed (IEP)

Indicative Equilibrium Price (IEP)/Indicative Equilibrium Volume (IEV) Benefits

- Transparency in the formation of opening and closing prices on the blind orderbook

- Reducing potential price fluctuations and volatility

Helping market participants execute transactions on the blind orderbook easily

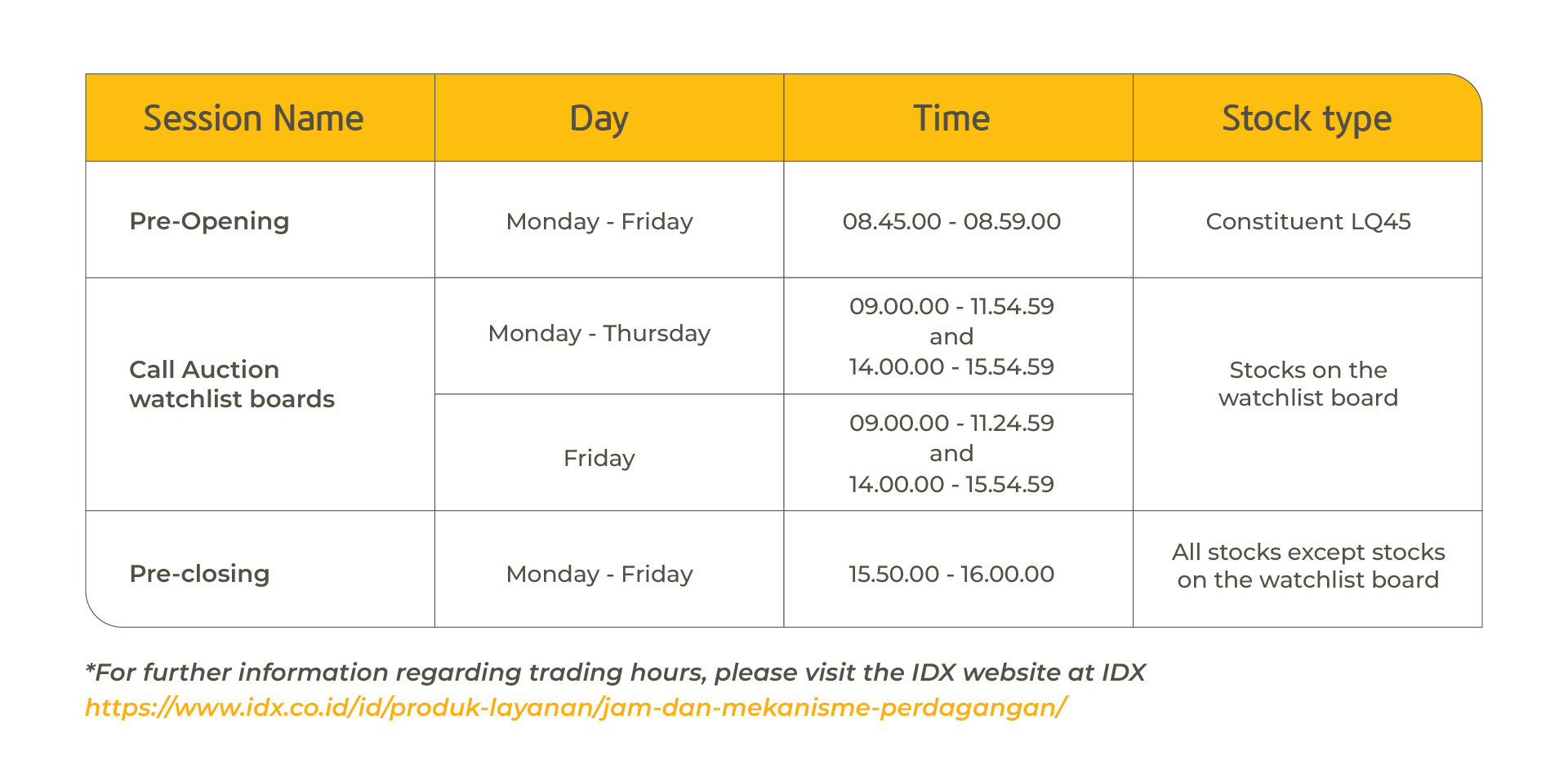

Trading session that include IEP and IEV information

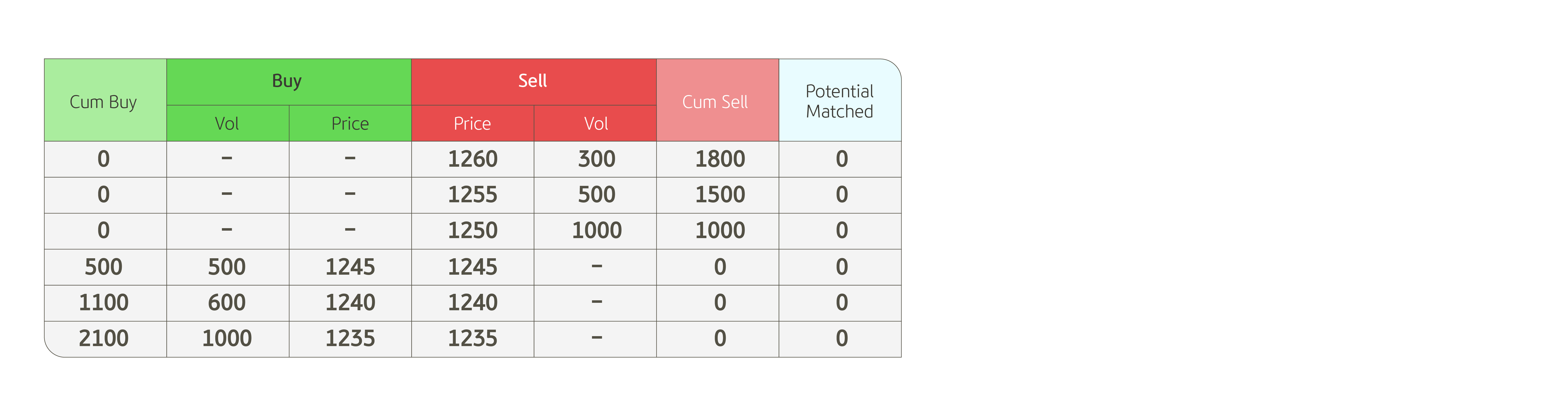

1st Illustration

There are orders that have the potential to be matched

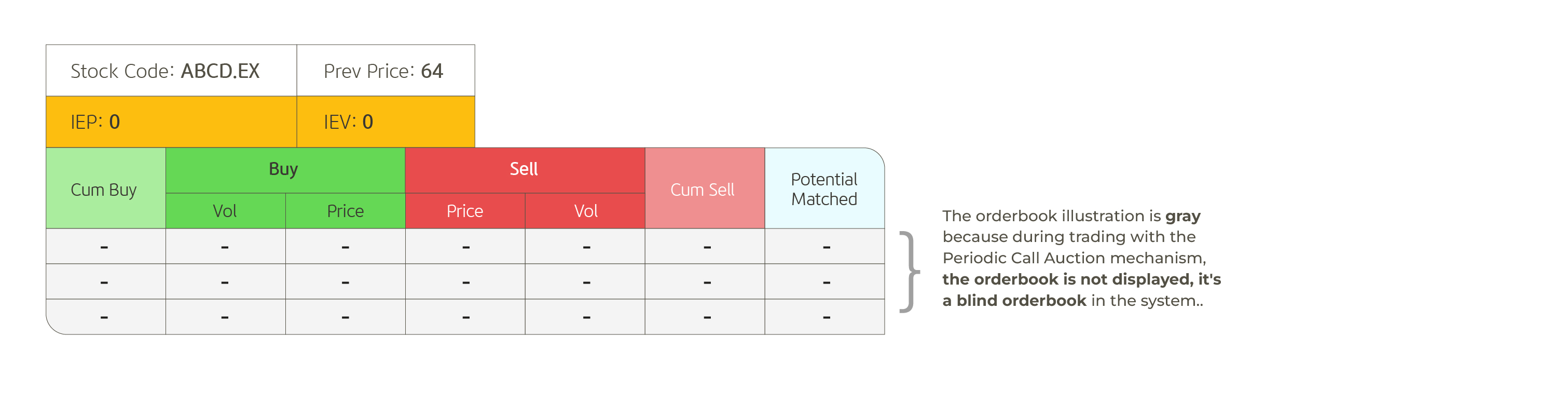

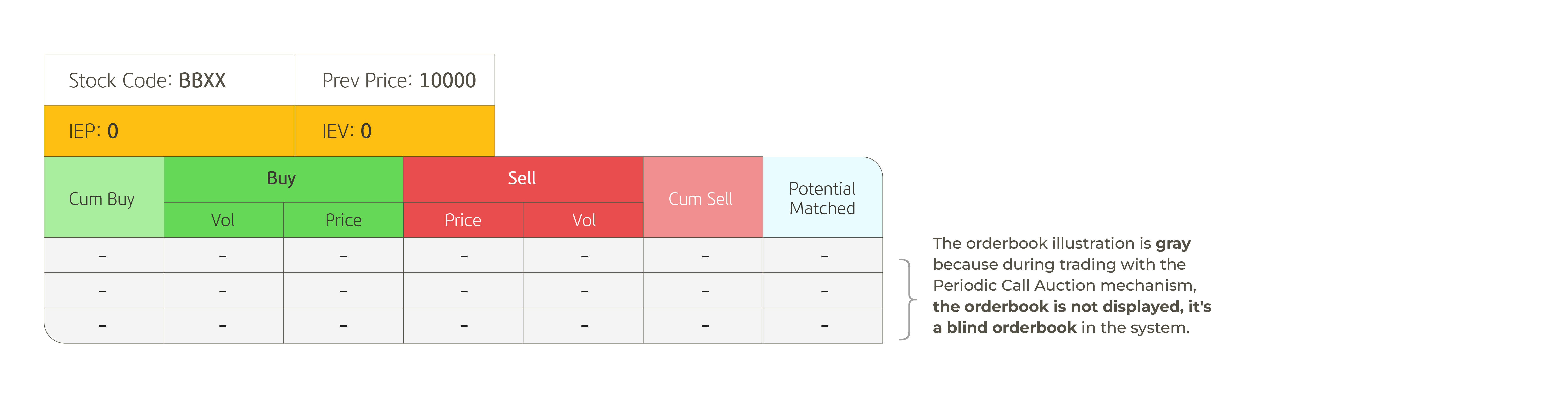

1. Before Order Collection Session

IEP dan IEV have not been formed yet because orders have not been received / are still being rejected by the system

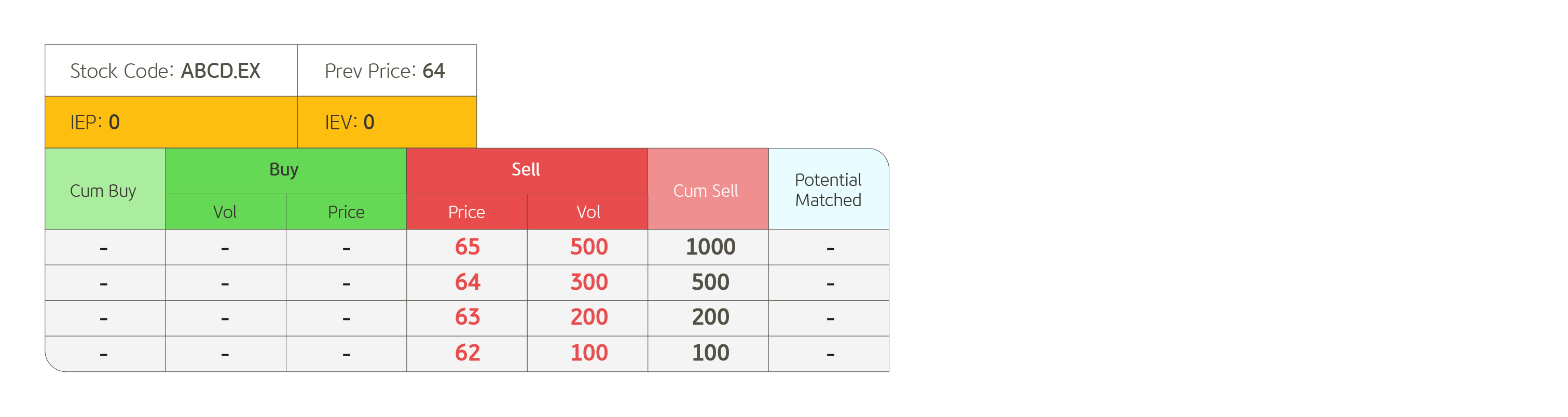

2. Entering the Order Collection Session

There are sell orders with varying prices, IEP and IEV have not been formed because there are no orders that have the potential to be matched.

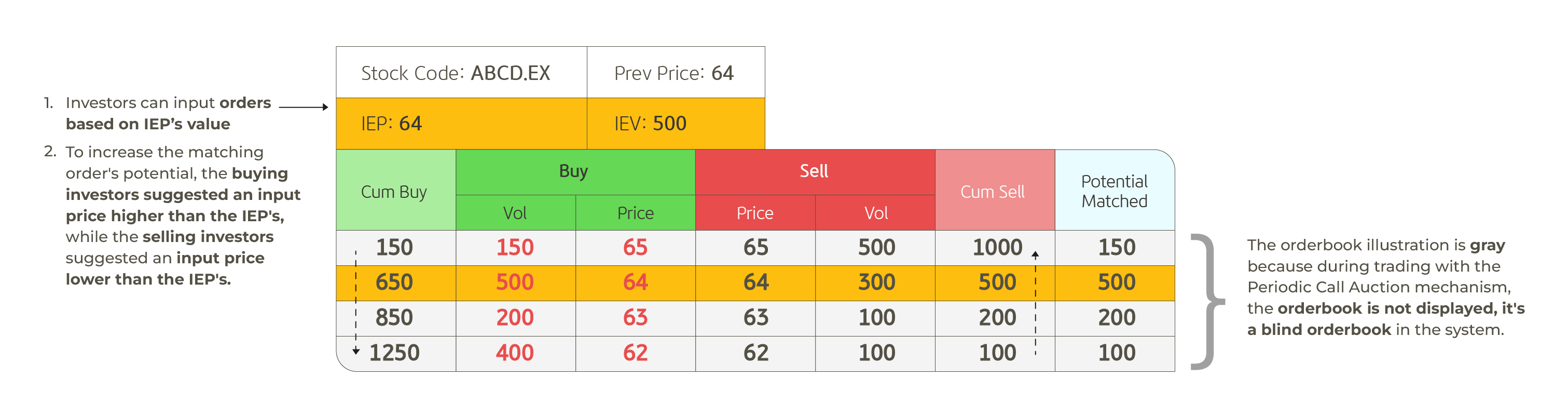

3. Order Collection Session

Entering buy orders with varying prices. IEP and IEV are formed at a price of 64 with a volume of 500. IEP is formed based on the largest potential match.

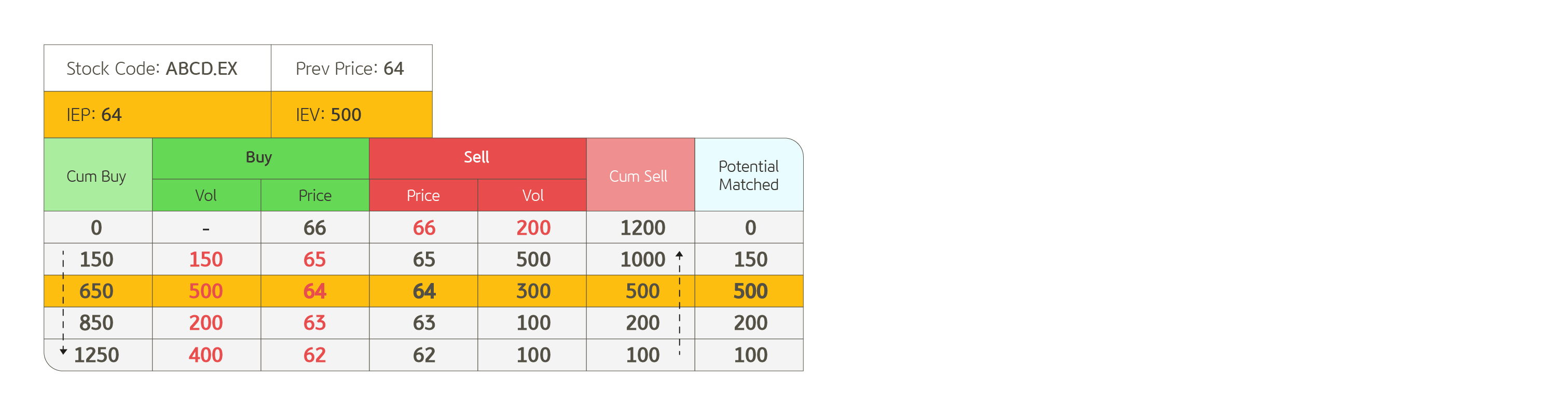

4. Order Collection Session

A sell order enters at a price of 66 with a volume of 200. Because the newly entered sell price is significantly higher than the potential equilibrium price (IEP), this sell order does not change the value of IEP

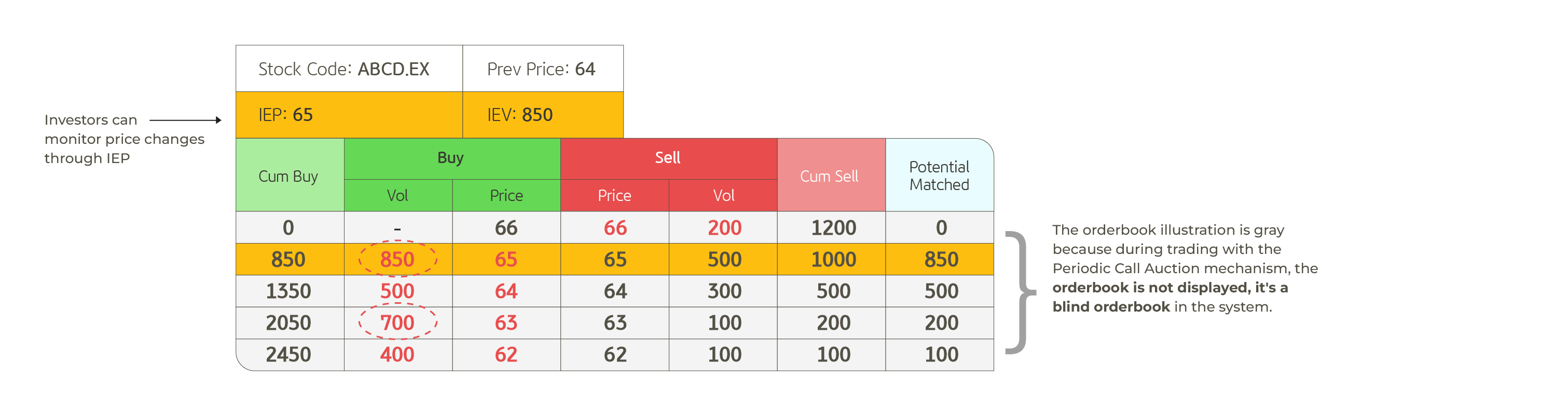

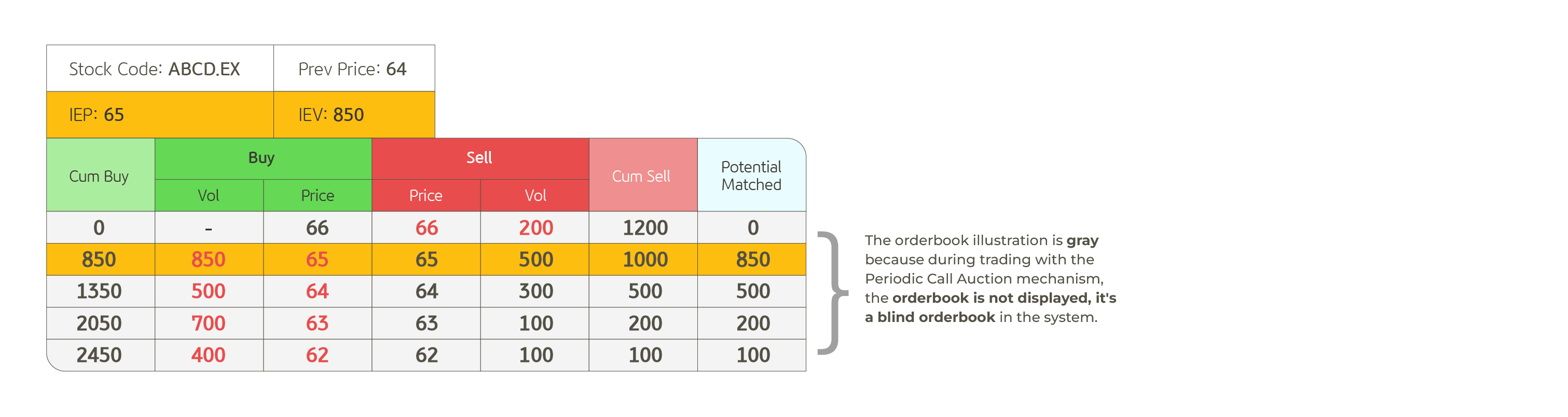

5. Entering Random Closing Session

Orders can be entered as long as the random closing is not triggered. Buy orders enter at a price of 63 with a volume of 500 and a price of 65 with a volume of 700. The impact of these two new orders, the values of IEP and IEV change.

6. Random Closing Session Triggered

When random closing session is triggered, investors are unable to take any actions (input/amend/withdraw orders)

7. Order Matching Session Triggered

When the order matching session is triggered, investors cannot take any actions (input/amend/withdraw orders). After Matching order triggered, investors can only withdraw orders

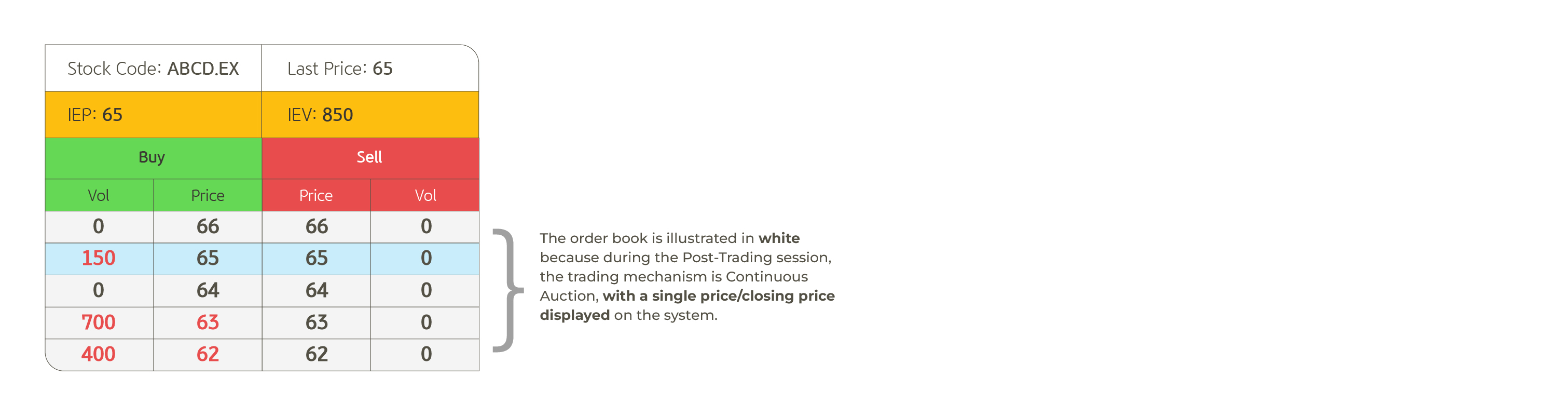

8. Entering Post Trading Session

The price formed and used as the reference close price is 65. If the remaining open orders carried over from the previous session are not amended or withdrawn, the system will automatically withdraw those orders

9. Post Trading Session

Investor amends buy order price to 64 with a volume of 500 and amends sell order price to 66 with a volume of 200 to match the close price

10. The End of Post-Trading Session

At the end of the post-trading session, the volume of orders matched at the close price is 350. Since there are still open orders that have not been matched by the end of the session, those remaining open order will be automatically withdrawn by the system

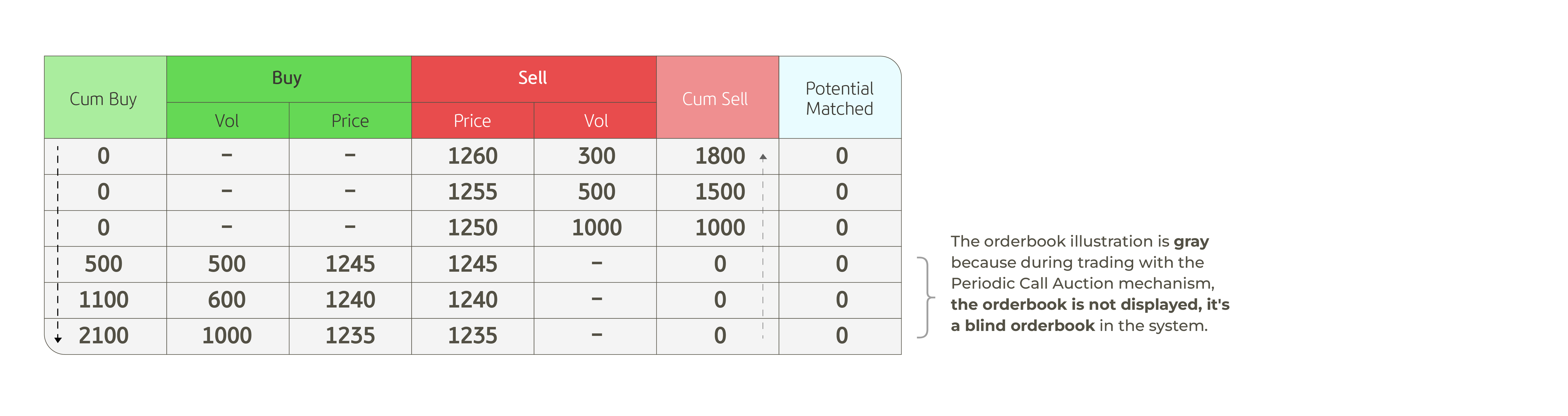

2nd Illustration

Order has no potential to be matched

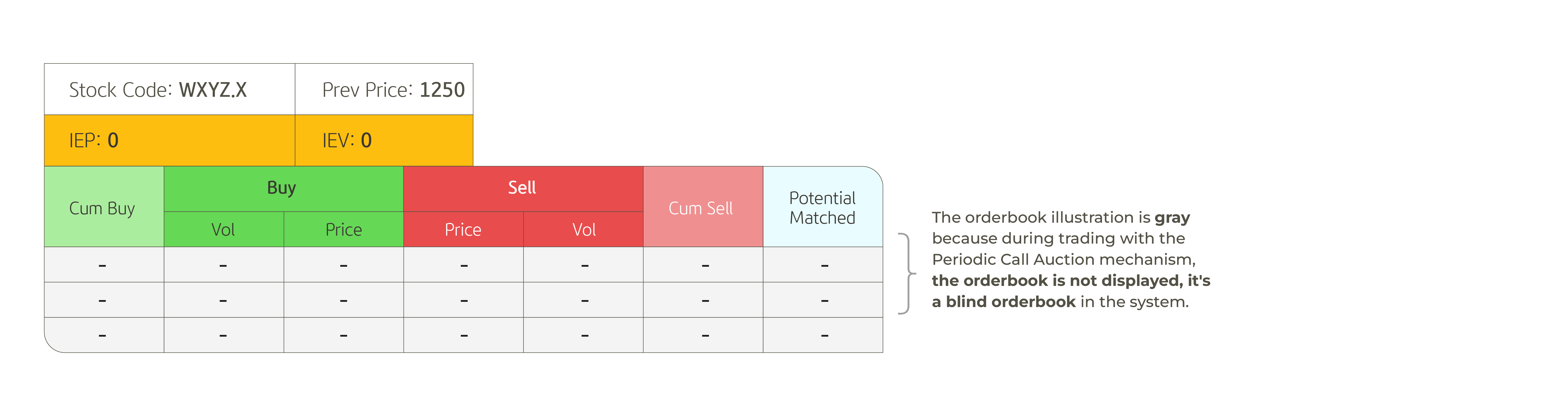

1. Before the Order Collection Session

IEP and IEV have not formed because orders have not been accepted/still rejected by the system

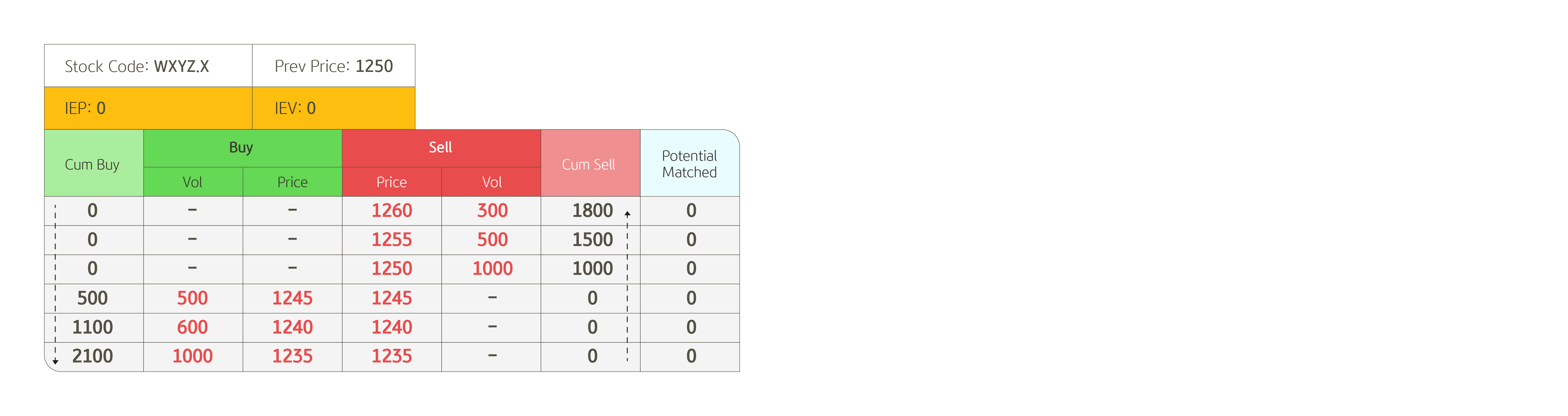

2. Entering the Order Collection Session

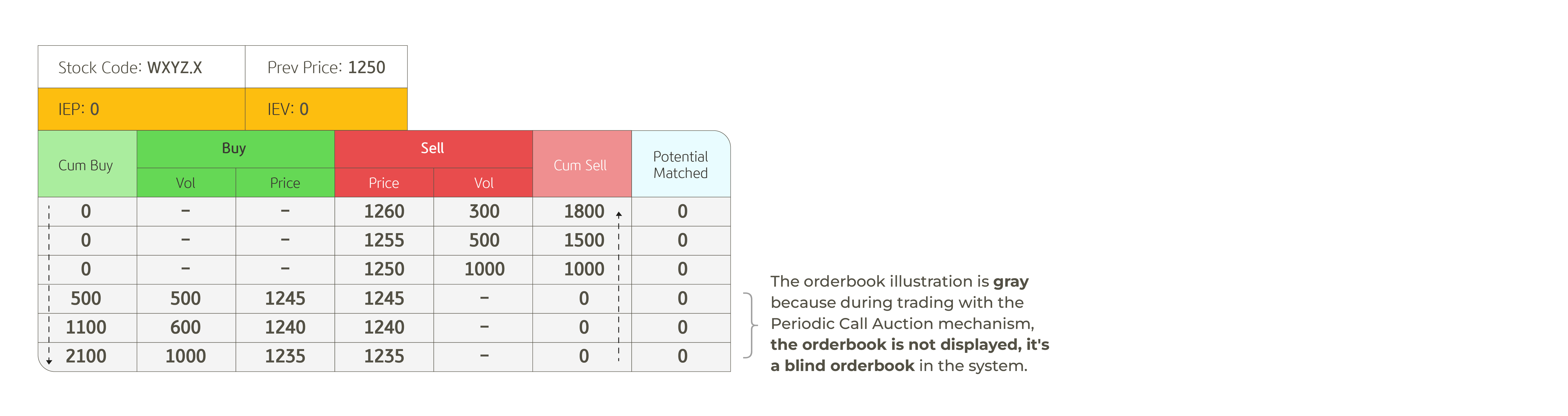

There are buy and sell orders with varying prices, IEP and IEV have not formed because there are no orders that have the potential to be matched

3. Order Collection Session

Until the end of the order collection session there are no new orders have entered. Therefore, the values of IEP and IEV remain 0

4. Random Closing Session

Until random closing is triggered there are no new orders have entered. Therefore, the values of IEP and IEV remain 0

5. Matching Order Session

Until the matching order is triggered, there are still no new orders. The values of IEP and IEV remain unchanged from the beginning of the order collection session, which is 0. The open orders continue to carry over to the post-trading session

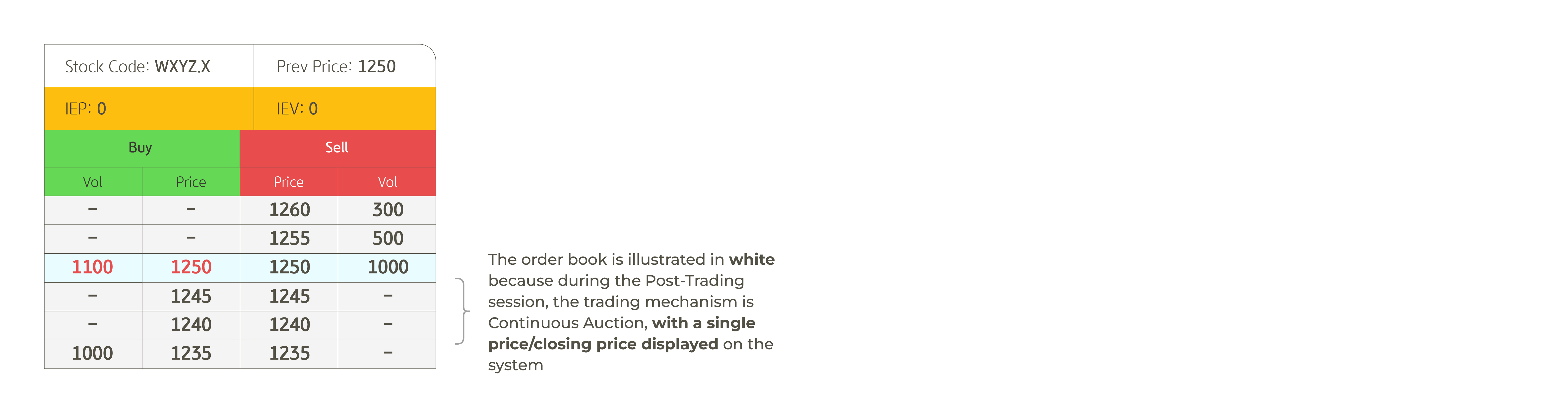

6. Post Trading Session

During the post-trading session, investors amend buy orders at prices of 1245 and 1240 to match the close price with a total volume of 1100

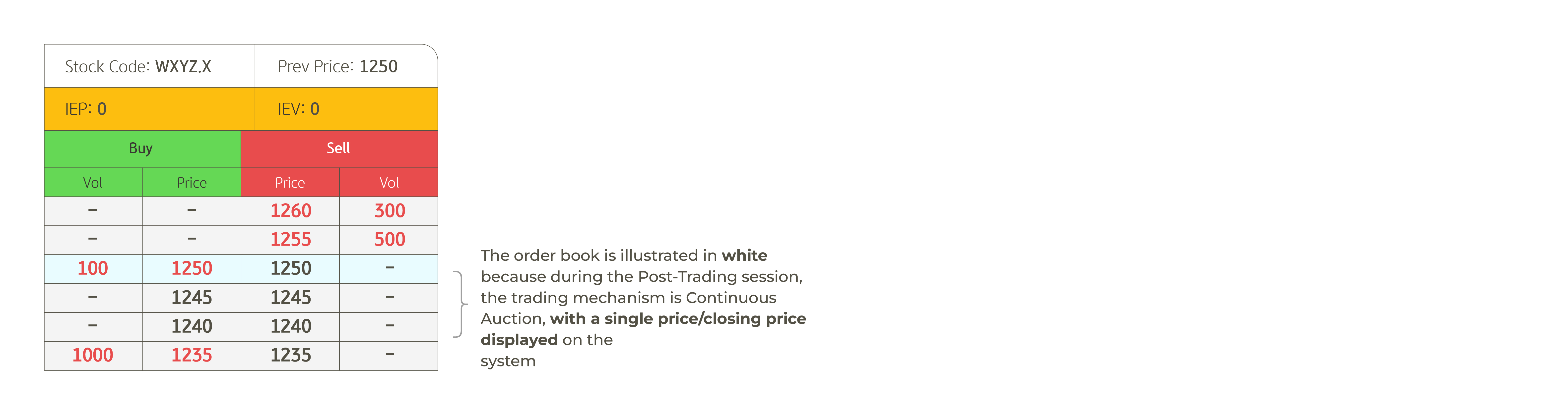

7. Post Trading Session

After amending orders, the buy and sell orders are matched at the close price with a total matched volume of 1000. Any remaining open orders will be automatically withdrawn by the system

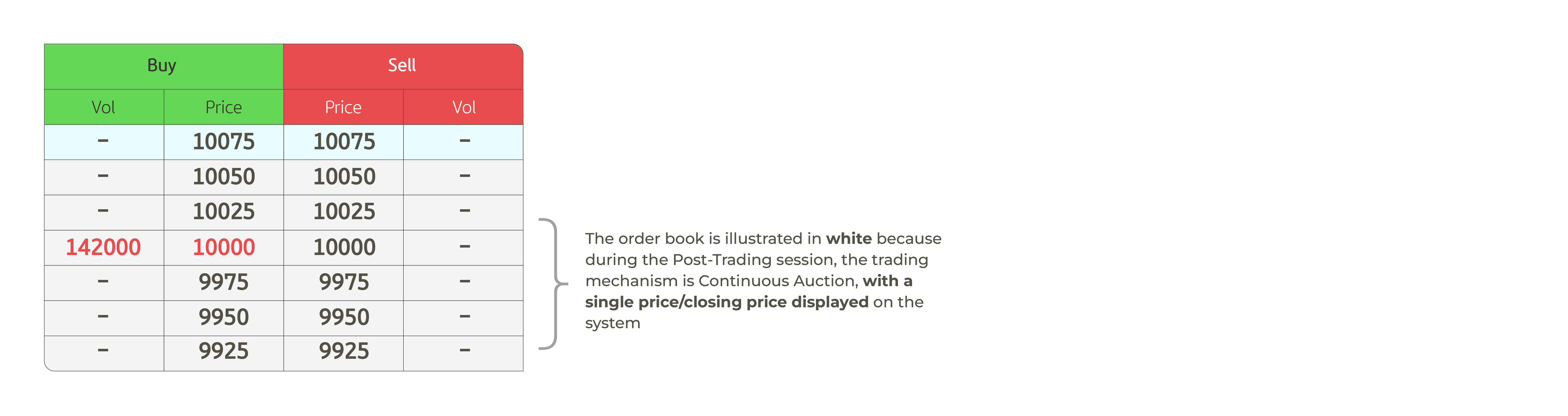

3rd Illustration

There are large orders that have the potential to be matched

1. Before the Order Collection Session

IEP and IEV have not been formed because orders have not been accepted or are still rejected by the system

2. Entering Order Collection Session

There are buy and sell orders with varying prices in large quantities, IEP and IEV are formed

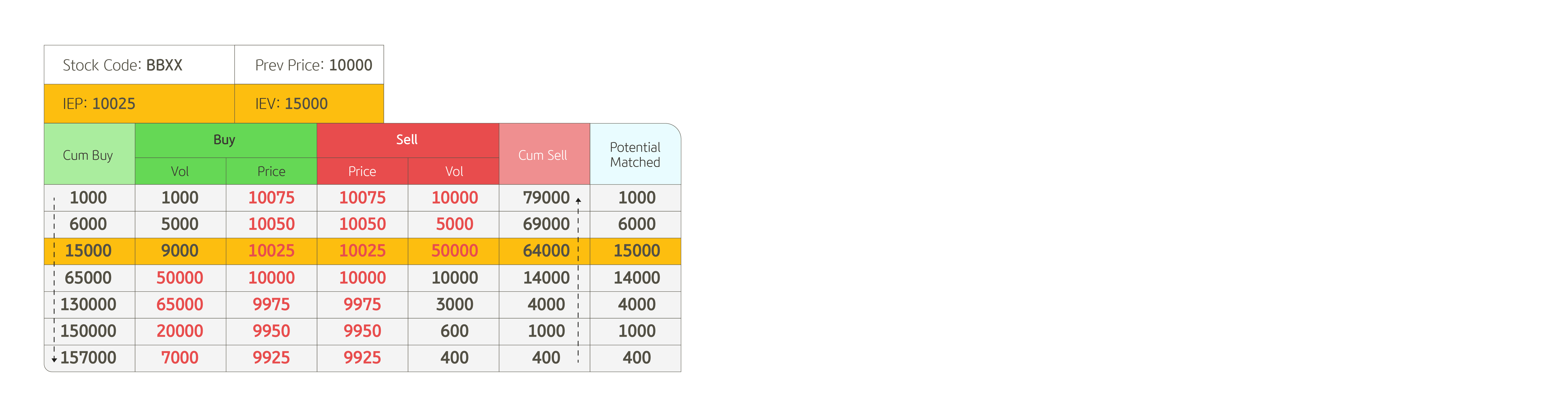

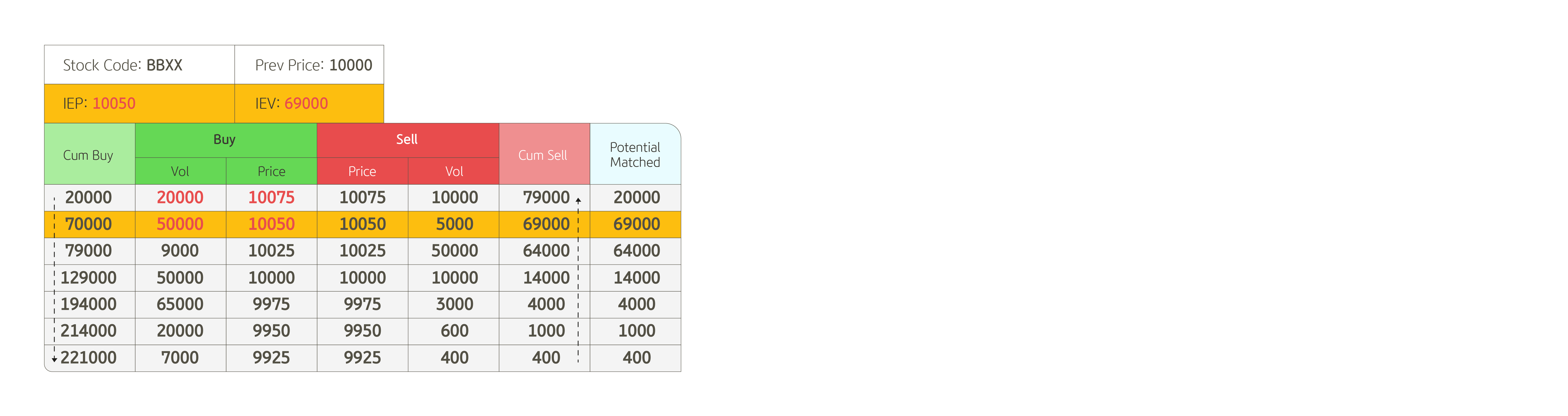

3. Order Collection Session

The entry of a large number of buy orders above the value of IEP changes the values of IEP and IEV

4. Entering Random Closing

At the random closing session, investors amend buy orders at the prices of 9925, 9950, and 9975 to a price of 10000. Then, they amend sell orders at a price of 10025, causing the IEP value to decrease to 10025

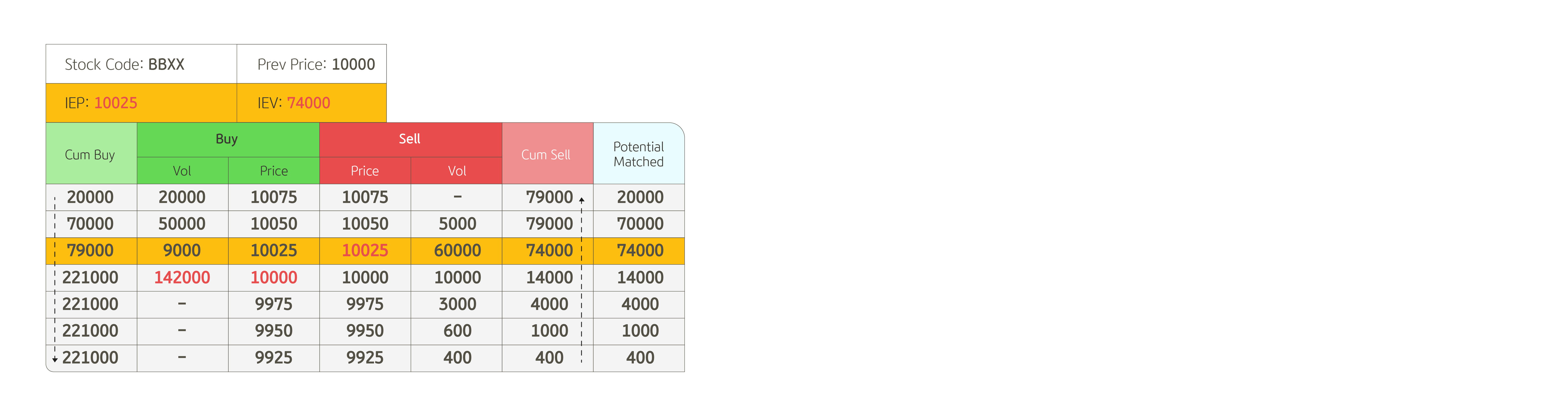

5. Matching Order

In the price matching session, the formed price is 10075 with a total matched volume of 79000

6. Post Trading

Until the end of the post-trading session, buy orders with a price of 10000 or below the close price of 10075 are not amended. Therefore, the system will automatically withdraw those open orders

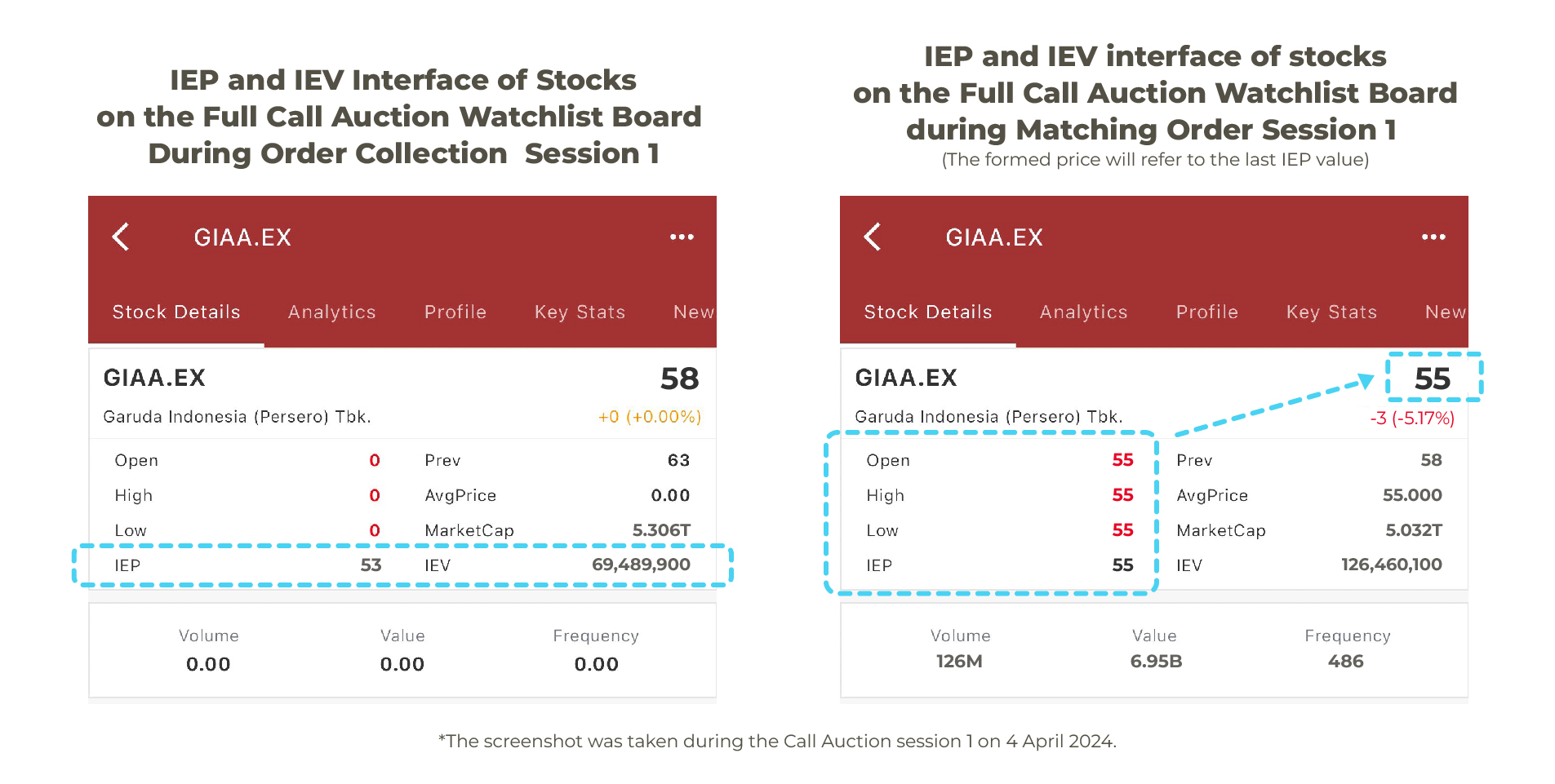

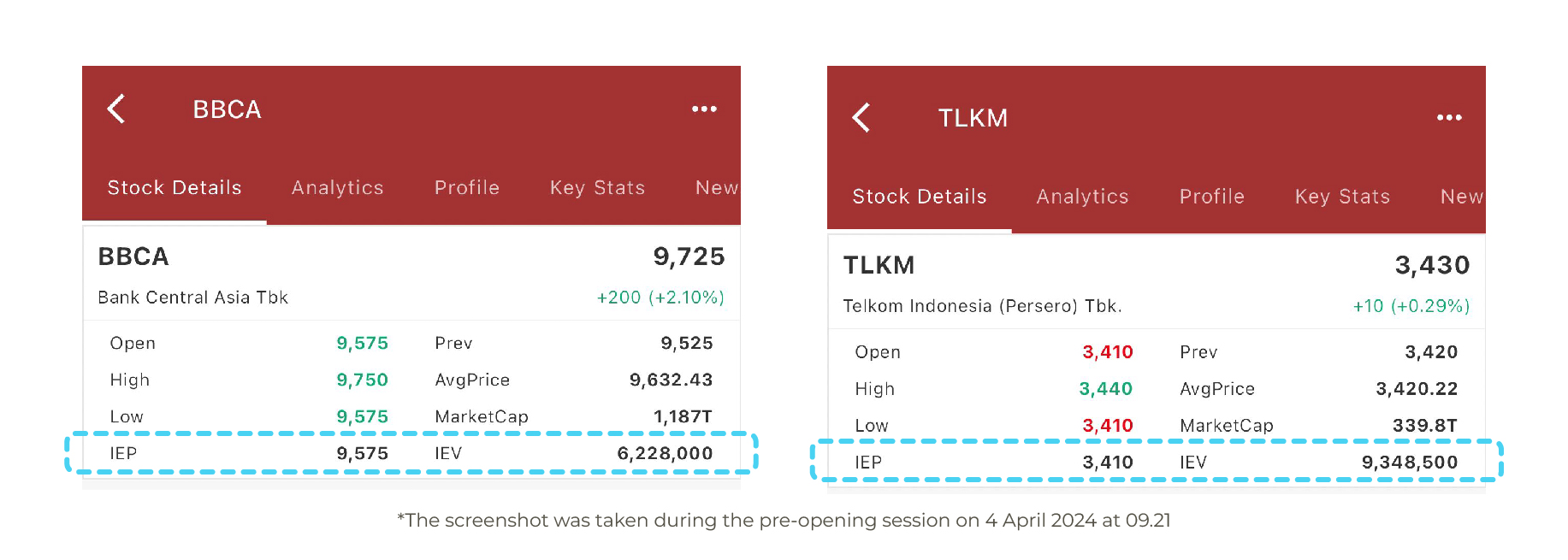

Example of IEP and IEV Interface

IEP and IEV Interface in the Pre-Opening Session

IEP and IEV Interface of Stocks on the Watchlist Board