IPO Bonds OKI Pulp & Paper Mills

PT OKI Pulp & Paper Mills, a key subsidiary of Asia Pulp & Paper (APP) Group, is one of Indonesia’s leading integrated producers of pulp, tissue, and paper-based products. The company operates across the full value chain—from wood processing to the production of bleached hardwood pulp, tissue, packaging, and stationery—serving domestic and international markets with advanced fiber technology and precision manufacturing.

All raw materials are sourced from 100% certified industrial plantations (HTI), and its pulpwood suppliers are certified under both mandatory and voluntary schemes, including PEFC and IFCC, aligned with global standards like ISO and IAF.

PT OKI holds ISO 9001:2015 certification for its quality management system and ensures its products meet international safety, health, and halal standards—including MUI’s Halal Assurance System since 2019.

Sustainability is central to PT OKI’s operations, in line with APP’s Sustainability Roadmap: Vision 2030, emphasizing responsible sourcing, efficiency, and stakeholder engagement.

To support future growth and investment in sustainable operations, PT OKI is currently offering bonds through an Initial Public Offering (IPO). This marks a strategic step to strengthen its capital structure, fund capacity expansion, and reinforce its position in the global pulp and paper industry.

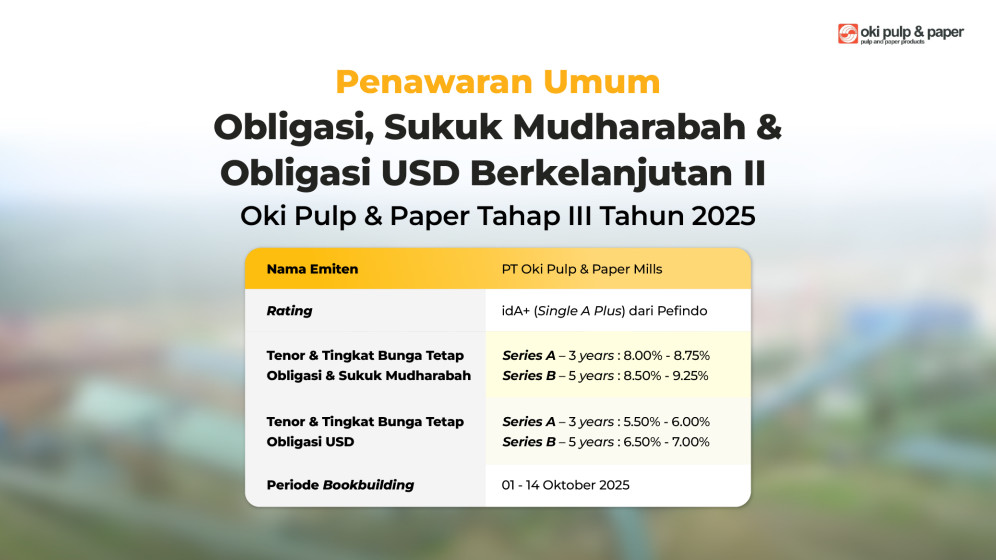

| Issuer Name | PT Oki Pulp & Paper Mills |

|---|---|

| Bond Name | Penawaran Umum Obligasi, Sukuk Mudharabah & Obligasi USD Berkelanjutan II OKI Pulp & Paper Tahap III Tahun 2025 |

| Rating | idA+ (Single A Plus) - Pefindo |

| Tenor and Interest Rate | Series A – 3 years : 8.00% - 8.75% Series B – 5 years : 8.50% - 9.25% |

| Tenor and Interest Rate - Bond USD | Series A – 3 years : 5.50% - 6.00% Series B – 5 years : 6.50% - 7.00% |

| Bookbuilding Period | October 1-14, 2025 |